File Your 1099-NEC Forms Now: Deadline Approaching Fast!

The 1099-NEC form is a critical tax document for businesses that work with independent contractors, including those in the trucking industry. If you run a trucking business, understanding this form and the filing process is essential for staying compliant with IRS regulations and avoiding potential penalties.

What Is the 1099-NEC Form?

The 1099-NEC ("Nonemployee Compensation") form is used to report payments made to independent contractors or vendors who are not employees of your company. If you’ve paid $600 or more in a fiscal year to a contractor for services, you are required to file this form with the IRS and provide a copy to the contractor.

When Should You Use the 1099-NEC Form?

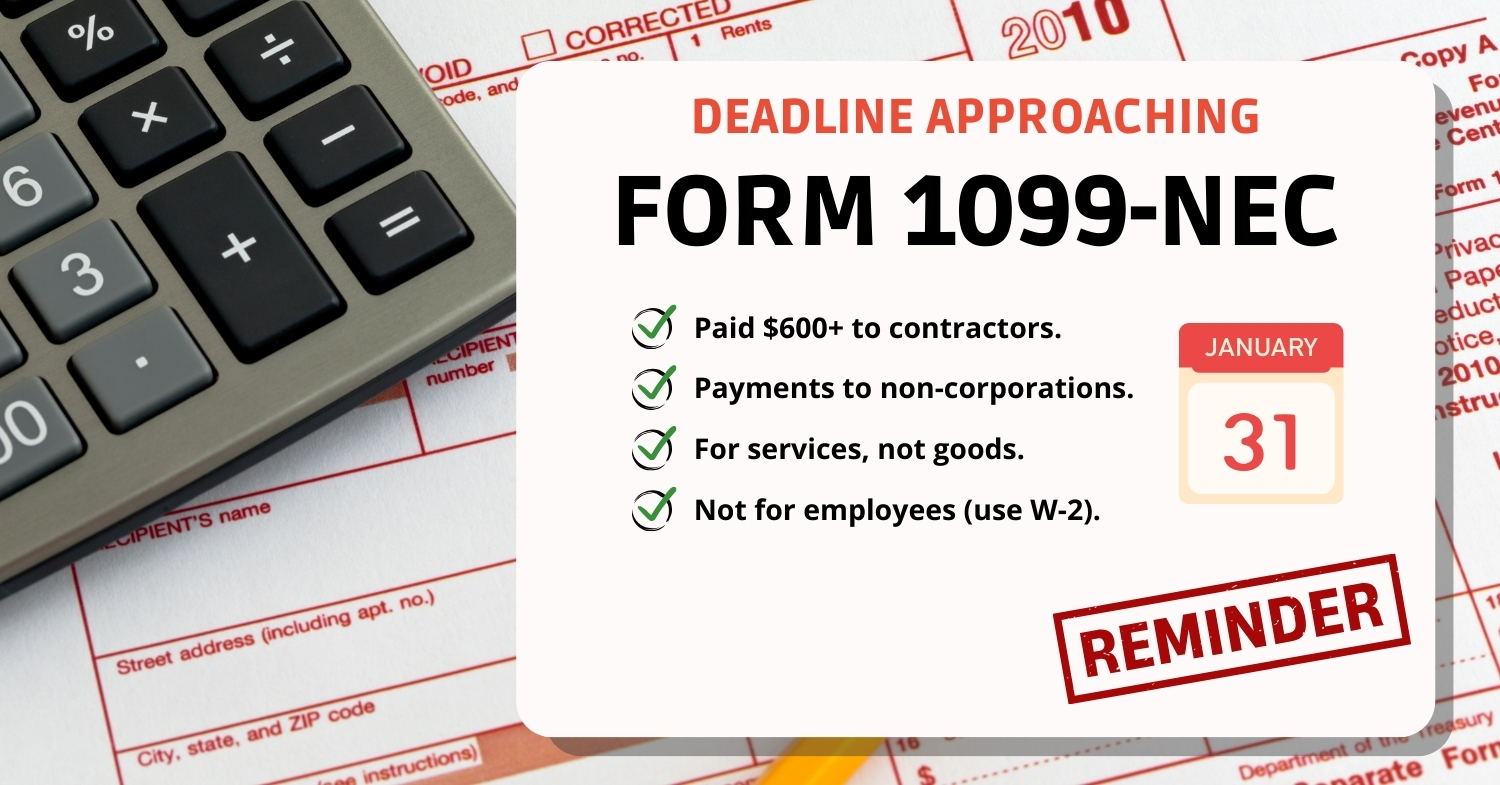

You must use the 1099-NEC if:

- You paid $600 or more to an independent contractor in a fiscal year.

- The payment was for services provided to your business and does not include goods or products.

- The payments were not made to a corporation (with some exceptions, such as legal services).

- The contractor is not an employee of your business.

What Is the Deadline for the 1099-NEC?

The deadline for filing the 1099-NEC is January 31. This includes:

- Sending a copy of the form to the contractor.

- Filing the form with the IRS.

It’s important to meet these deadlines to avoid penalties.

How to Prepare the 1099-NEC Form

Preparing the 1099-NEC form is straightforward if you have the right information. Here’s what you need:

- Identify Contractors: Ensure you have complete information for each contractor, including their name, address, and tax identification number (TIN or EIN).

- Review Payment Records: Check your financial records to verify the exact amounts paid.

- Use a Management Tool: Platforms like Trucker Ally can automate the process, making it accurate and efficient.

- File the Forms: Submit the forms electronically or by mail, ensuring they are filed by the deadline.

Benefits of Using Trucker Ally for 1099-NEC Forms

At Trucker Ally, we make the preparation and filing of 1099-NEC forms quick and hassle-free. Our platform:

- Automates form generation.

- Reduces the risk of errors.

- Ensures compliance with IRS regulations.

- Simplifies form distribution to your contractors.

Consequences of Failing to File the 1099-NEC Form

Failure to file the 1099-NEC form can result in significant penalties. These penalties vary depending on how late the form is filed, starting at $50 per form and increasing to $270 per form or more, depending on the severity of the delay.

Conclusion

Staying compliant with tax obligations is crucial for the success and sustainability of your trucking business. Understanding and properly managing the 1099-NEC form helps you avoid penalties and maintain good standing with the IRS. At Trucker Ally, we’re here to support you with tools that make this process easier and more efficient.

Don’t wait until the last minute—start preparing your 1099-NEC forms today with Trucker Ally.

#TruckerAlly #1099Form #TaxCompliance #TruckingBusiness